Frequently Asked Questions

Below we provide some of the questions and answers that we believe you may have in respect to our business activities. We attempted to provide these questions and answers in a language and format that we believe could help our investors to grasp and understand our business easier. However, this information is not all inclusive. You should obtain more information by reading our disclosures filed with the U.S.SEC and by seeking a competent advice from your investment, financial, and legal advisors.

What is Convertible Lease Holdings LLC?

Convertible Lease Holdings LLC ("CLH" and the "Company") is a holding company founded for the common good of liberating home ownership from debt by substituting mortgages with long-term, tenant-driven leases. The Company's goal is to become the #1 alternative to the debt-based home ownership by year 2050.

What does Convertible Lease Holdings do?

We develop, acquire, own and lease residential real estate properties. We also develop, own, and license out the intellectual properties in form of fundamental methodology and non-FICO based algorithms programmable into a computer-operated property technology. This technology is intended to operate and improve our convertible lease methodology and, in future, offer the novel resident credibility system to landlords around the world.

What is the Mission?

Our mission is to help people creating the world without mortgage debt. We believe that any debt is a form of financial slavery, and mortgage debt is not an exception. With that mission in our hearts, we dare to challenge the status-quo of a mortgage-based home ownership by creating and incrementally developing the fundamental convertible lease methodology and our non-FICO based resident credibility system.

Who founded the convertible lease?

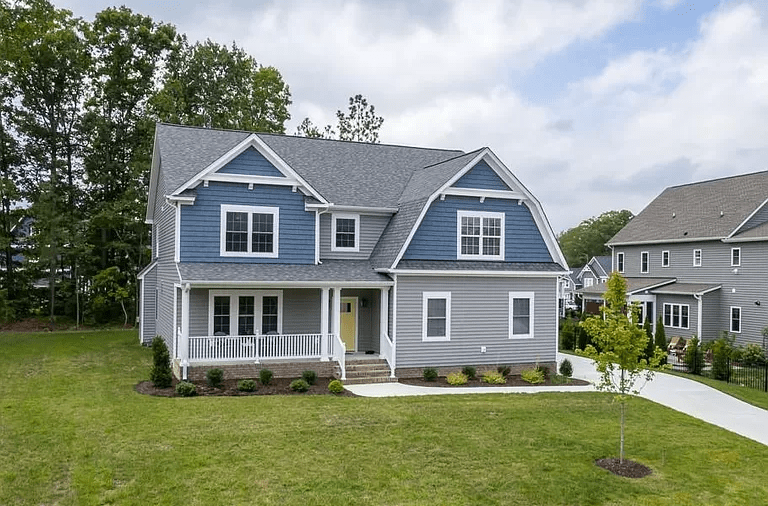

Convertible Lease was conceptually conceived and invented by Sergey Gurin in 2015 as a result of a decade-long research and thought-process. Sergey Daniloff joined in 2018 to provide the initial capital and manage the affiliate property acquisitions. Casey Sowers joined in 2022 to manage construction of the world's first convertible lease neighborhood in Chesterfield, Virginia. The trio have founded Convertible Lease companies by end of 2022 as a result of initial collaboration.

Where is Convertible Lease Holdings located?

Convertible Lease Holdings LLC is domiciled in Florida. Our administrative office is located in Miami Gardens, Florida. Our Virginia operations are conducted by our affiliate under common managerial control, Convertible Lease Virginia LLC, located in Midlothian, Virginia which is a western suburban of the Richmond, VA area.

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

What business are we involved in?

Convertible Lease Properties LLC. (“company,” “we,” “us,” “our,” “issuer,” and words of similar meaning) operates as an asset holding company with assets comprising real estate and intellectual properties. Our general business plan is to commence principal operations as a residential lease operator, and gradually evolve into the technology royalty and licensing business.

What are we trying to achieve as a business?

Our goal is to become the #1 alternative to home-based home ownership by year 2050. We progress in achieving our goal by developing a conceptually new standard that is aimed to keep the home ownership affordable while reducing the total cost of ownership and protecting the principal homeowner rights for present and future generations.

Our business objectives include but are not limited to:

- Developing the cornerstone principles for the convertible lease methodology.

- Developing the AI-operated algorithms for the fundamentally-new, Non-FICO based tenant credibility system.

- Aggregating approximately 10,000 properties to conduct a full-scale, comprehensive pilot test in our strategic regions.

- Protecting principal investment capital through asset-backed methods.

- Developing a stable and diverse source of risk-adjusted monthly income with monthly distributions to our shareholders.

- Increasing our NAV through acquisition of real estate properties below market and by application of convertible lease method.

- Developing the asset portfolio that provides a return profile with lower volatility and stronger competitive differentiation.

- Achieving the liquidity event for our shareholders through the listing of our securities for over-the-counter trading.

What is the novelty behind the convertible leasing?

The basic novelty is that you are no longer pressed to make an "either-or" decision on whether to take on a huge mortgage debt or to walk away from your dream home. You can defer such a decision until later, and still get the home you like.

What is the value proposition?

Convertible lease helps people get a better home for less money and without a burden of the mortgage debt. Lease payments are structured to be competitive with the mortgage payments while varying by property, tenant ratings, and other criteria. All principal homeowner rights are contractually reserved in the name of homeowner-lessee and protected.

How do we make money?

We are earning an income by collecting lease payments, program participation fees, and gains from our investments.

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

So, how it works? Give me an example...

Our programs are structured based on proprietary patented hybrid finance model that enables a person to defer a "rent-vs-buy" decision until any time during the lease terms, while retaining the principal homeowner rights from the effective date.

By an example, it works similar to car lease vs. car rental vs. car loan. Instead of taking a mortgage loan, you can lease a property from us for a continuous long-term based upon a contract, which reserves your contractual rights and obligations that are substantially similar to the homeowner rights and obligation in case of a mortgage. Similar to car lease (and most rentals), you maintain the property until return, and/or can exercise a conversion option at the end of lease term for a predetermined amount set in your contract. Different from cars though, real-estate properties normally appreciate in value with time. Similar to a mortgage borrower, you can build an equity by possessing, maintaining, and improving the property during the lease term. You can sell the property at any time during the lease term by using the realtor and title transfer company duly authorized by us. At closing, you will reimburse us our costs of holding the property for you during the lease term, and keep the cash surplus as your profit.

What is the mission?

Our mission is to help people creating the world without mortgage debt.

Is mortgage debt bad?

No, there is nothing wrong with using debt to improve quality of your life, for as long as the debt is used responsibly. For illustration and without limitation, we believe that buying a house when you have to borrow to cover your realtor commissions is irresponsible vs. Borrowing a mortgage when you have enough cash and equivalents to cover 6 months or more of your payments is acceptable. Another example could be the adding a home equity line to your mortgage to build an expensive and unnecessary improvement (like a swimming pool and surrounding area) vs. the adding a home equity line to fix a leaking roof, which we believe is a responsible borrowing.

????

In our money management philosophy, exchanging a debt-free asset for a long-term liability is not a proper. ????

What does “liberating home ownership” means in practical terms?

In simple words, we are offering people an opportunity to own a home at a cost lesser than a traditional mortgage while enjoying a greater financial freedom. Different from the mortgage lending contracts, convertible lease is based on the contractual interests that are organically balanced between us and our homeowners by using a mutually beneficial, straight-forward, transparent, and socially responsible approach to home ownership – the home ownership of next generation. Effectively, we hold the homes for our homeowner-lessees until their respective conversion dates and pay-out their equity portion from closing according to each individual contract.

What homeowner rights does the convertible lease reserve in the resident name?

The mortgage-borrowers have five main implied advantages (cited below) by comparison to those who rent. A mortgage-borrower is contractually entitled to:

- Occupy the property on his or her terms (i.e. without landlord-required restrictions on pets, smoking, etc.)

- Make changes and/or improvements to the property as he or she see fits.

- Sell the property when and as he or she sees fits (including short-sale.)

- Accumulate a homeowner equity with time, which may become a capital gain at the time of sale.

- Write-off the interest amount paid from his or her taxable income (subject to limitations.)

Our convertible lease contract provides a homeowner with all five main advantages cited above at a cost lesser than a mortgage cost.

What does “debt-free” means for a homeowner-lessee?

The term “debt-free” as it's used in convertible leasing means that you contractually reserve the homeowner rights similar to those of the mortgage borrowers while retaining the flexibility to exit from your possession of the property as a renter. Since there is no mortgage contract, there is no debt load on your credit report and no long-term debt obligations.

Why the convertible lease is better than a mortgage?

The main difference is that convertible lease helps you defer the property taxes, HoA dues, insurance fees, and major repair costs, hence helping you to keep more money for your immediate financial needs. It is designed to balance the benefits between the homeowner-lessee and the asset holder-lessor. While the mortgage lenders simply let you use their money and you assume all risks, the lessors let you use the property and share the risks with you. While in some cases (depending on the homeowner credit score,) the mortgage payment may be lower than the lease payment for the same property, the aggregate monthly lease payments are always lower than the aggregate mortgage payments:

[comparison table here]

Down-payment

Interest/Lease payment

HoA dues

Insurance fees

Major repair costs

Why the convertible lease is better than regular rent?

???.

Why the convertible lease is better than rent with option to buy?

Why the convertible lease is better than rent with option to buy?

Convertible lease is somewhat similar to the rent with buy-option, but features different integral components and action mechanics. Similar to the strike price in the option to buy, the convertible lease has a fixed price for the property called the “conversion price.” Different from the option to buy, the convertible lease does not have an expiration date. Further different from the option to buy, the convertible lease cannot be sold or assigned to a third party - You simply sell the property by engaging a realtor as a mortgage-borrower would do. We believe the convertible lease is better than the rent with option to buy because it gives the tenant-resident more freedom and less pressure for the exercise of his or her contractual rights.

Why is a mortgage-based home ownership becoming obsolete?

For most American households, a home is the largest single purchase of a lifetime. At the same time, buying a home comes with least warranty, no return policy, and at an aggregate ownership cost that is a double or triple of the property purchase price (if we account for mortgage-related costs and property taxes for a 30-year mortgage.) While the property taxes increase continually as well, the aggregate costs are mostly driven by the mortgage terms that feature several disadvantages to the borrower. In essence, the home ownership under mortgage is branded into peoples’ minds, and the reality is different. The reality is that mortgage-based homeowners pay each and every expense for the property, while their homes belong to the lenders as collateral.

For thousands of years in business, the mortgage lenders developed a “take it or leave it” approach to issuing loans that force a borrower to agree to whatever terms are offered to them at closings. Most homebuyers simply sign the closing documents without reading those in details, let alone understanding the contractual intricacies. Hence, people take on a huge debt under the terms and in the economic environment that is beyond of their control. When people purchase a home with no- or low down-payment, they cannot afford sustaining financial pressure in the times of economic hardship. When people purchase a home with large down-payment, their equity shifts towards the lender in the times of economic hardship.

Since the lenders’ principal business is issuing debt, the lenders must issue increasingly more debt to sustain business growth. As a result, lenders tend to continually issue debt to the borrowers who do not have capital reserves sufficient to sustain financial pressure. In an environment where new monetary theory effectively driving the emission of fiat money, and where federal government is backing the mortgages while being in significant debt itself, we believe the thousand-year-old mortgage system is climaxing and is gradually becoming obsolete.

The early symptoms of the traditional mortgage system becoming inadequate has been revealed by the 2008-2009 Financial Crisis and has been evidenced repeatedly since. When it collapses again, the traditional mortgage system may harm the mortgage borrowers harder than in 2008-2009, due to several reasons chief among which is the corporate and consumer debt. A novel, well thought-through alternative is needed, which would replace the old system going forward. To function property, such new system must not be based on debt. It shall be based on well-balanced contractual interests between the asset holders (i.e. lenders, landlords, etc.) and the asset users (i.e. homeowners, renters, etc.) as well as on fair, sustainable, and socially responsible approach to the home ownership as one of main factors of societal welfare.

Does the convertible lease offer a solution to keeping the homes affordable?

Convertible lease may become a viable alternative to the mortgage-based home ownership. While we have no ability to influence the fiscal and monetary policies, local property taxes, or lending standards, we believe that the solution humanity needs must be effective and simple. We believe that the governing principles of such a solution must be kept free of complications and must be resistant to the pressure for corporate earnings. With those criteria in mind, we are developing the convertible lease to be an alternative to the traditional mortgage system that could help people building a stronger financial position to sustain their payments in the times of economic hardship.

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

What ????

Essentially, ???

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

Why did Convertible Lease Holdings LLC go public?

We believe that peoples' homes must be owned by the people, not by the banks dictating the lending terms.

What do we offer to the investors?

We are offering the investors to collectively participate in the acquisition of our real estate and intellectual properties.

What is the novelty behind the convertible leasing?

The basic novelty is that you are no longer pressed to make an "either-or" decision on whether to take on a huge mortgage debt or to walk away from a home you'd like to purchase. You can defer such a decision until later, and still get the home you like. Similar to a

Are the intellectual properties and technology owned by Convertible Lease Holdings LLC?

Yes. When you make an investment into our real estate assets, your equity ownership does automatically extend to all of our assets, including, without limitation, our intellectual properties.

Is the investment subject to risk?

Yes. You should carefully read the section of our offering circular entitled “Risk Factors” and consider the feasibility of our offering to your financial conditions prior to investing into any of our securities. If you cannot afford a loss of a portion of or your entire investment, you should not invest into any of the Shares we offer. Starting from $10, you should only invest such an amount of money that you can risk with.

Can I compound my equity by reinvesting my monthly distributions?

Yes. You can elect to either withdraw or reinvest all or a part of your monthly distributions at your discretion. If you elect to reinvest, we will withhold and pay taxes on the amount of your contributions subject to reinvesting and will remit the remaining amount to your bank account.

Normally, in real estate investing, one must wait for a long time to accumulate enough free cash to reinvest. Convertible Lease Holdings LLC enables you to automatically reinvest any amount of your distributions, or any additional amount you wish to add to your equity every month starting from as low as $10.

How does the convertible lease works?

In a snapshot, people rent until they are ready to convert their lease into home ownership. Then they either convert or exit by forfeiting their rights to convert. If they convert, they reimburse our costs of holding their property for them, and keep the remaining equity cash-out.

Tell us which home you like and we will buy it for you. Lease it from us for up to 10 years to enjoy a homeowner lifestyle. Sell your home at any time during your lease to cash out your homeowner equity, or simply walk away as a traditional renter. The choice is yours.

What does the convertible lease offer?

In simple words, the convertible lease offers people an opportunity to own a home at a cost lesser than that of a traditional mortgage.

Who is a customer for the convertible lease?

The convertible lease is ideal for people seeking to rent or renting a home, and for people planning to buy a home with small down-payment.

What is the difference between the convertible lease and the mortgage?

The principal difference is in the legal title vs. equitable title for the property. With the mortgage, the homeowner holds legal title for the property that is held by the lender as collateral. With the convertible lease, the homeowner holds equitable title for the property that is held by the lessor as asset-backed equity. In practical terms, we believe the difference is that while you carry all risks of homeownership with a mortgage, you share such risks with your lessor through the convertible lease. For example, if value of the property decreases (i.e. 2008-2009 real estate crisis,) you will still be responsible for your mortgage payments, but could elect forfeiting your convertible lease. Another example may be made for a case where your air conditioning brakes down. In this example, a mortgage borrower would have to pay the repair cost immediately, whereas a convertible lease homeowner would have to pay the repair cost when and if he or she elects to convert their lease.

Different from the mortgage lending contracts, convertible lease is based on the contractual interests that are organically balanced between the landlords and the homeowners by using a mutually beneficial, straight-forward, and socially responsible approach to home ownership – the home ownership of next generation.

What is the novelty behind the convertible lease?

The basic novelty is that homebuyers are no longer pressed to make an "either-or" decision on whether to take on a huge mortgage debt or to walk away from a home they like. With the convertible lease, they can defer such a decision until later, and still enjoy their dream home.

How is the convertible lease different from a rent with option to buy?

?????

This is a Heading

????

Why the convertible lease is better than a mortgage?

Why the convertible lease is better than a mortgage?

The main difference is that convertible lease helps you defer the property taxes, HoA dues, insurance fees, and major repair costs, hence helping you to keep more money for your immediate financial needs. It is designed to balance the benefits between the homeowner-lessee and the asset holder-lessor. While the mortgage lenders simply let you use their money and you assume all risks, the lessors let you use the property and share the risks with you. While in some cases (depending on the homeowner credit score,) the mortgage payment may be lower than the lease payment for the same property, the aggregate monthly lease payments are always lower than the aggregate mortgage payments:

[comparison table here]

Down-payment

Interest/Lease payment

HoA dues

Insurance fees

Major repair costs

How does the convertible lease works?

Tell us which home you like and we will buy it for you. Lease it from us for up to 10 years to enjoy a homeowner lifestyle. At any time during your lease, you can either convert your lease into the traditional mortgage-based ownership or simply sell the house and keep the homeowner equity you have built.

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

What is the novelty behind the convertible leasing?

The basic novelty is that you are no longer pressed to make an "either-or" decision on whether to take on a huge mortgage debt or to walk away from a home you'd like to purchase. You can defer such a decision until later, and still get the home you like. Similar to a

Tell us which home you like and we will buy it for you. Lease it from us for up to 10 years to enjoy a homeowner lifestyle. At any time during your lease, you can either convert your lease into the traditional mortgage-based ownership or simply sell the house and keep the homeowner equity you have built.

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box

This is a Heading

You can edit text on your website by double clicking on a text box on your website. Alternatively, when you select a text box a settings menu will appear. your website by double clicking on a text box on your website. Alternatively, when you select a text box